PARIS — Thales will provide the French Navy with its first production version of an autonomous mine-hunting system by the end of the year as a first step to fully remote mine warfare, with the first system for the U.K.’s Royal Navy following in early 2025, the company said.

France and the U.K. are moving to stand-off mine countermeasures, a choice also made by the Netherlands and Belgium, while others including Italy and Germany are sticking with crewed minehunter vessels augmented by remote vehicles and drones, said Chris Cunnell. the Thales product line manager for autonomous mine countermeasures.

“Navies are going one of two routes,” Cunnell told Defense News at the Euronaval industry show outside Paris last week. “They’re either going to complete standoff – U.K., France, Belgium, Netherlands, the U.S. are all going a very similar route: They want to have crew outside of the minefield. Other navies have a philosophy that they continue to want to have a crewed mine-hunting capability, so that’s a vessel that will go into the minefield.”

The fully remote option has only now become really possible, according to Cunnell. Thales spent nearly 10 years developing the system it is delivering to France and the U.K., and started sea trials towards the end of 2020.

RELATED

“If you look at what the Italian Navy are doing, if you look at Germany, very different philosophies,” Cunnell said. “From a Thales perspective, we respect the fact that navies have different approaches, we can provide a toolbox and a system for both. It’s up to them.”

The systems for France and the U.K. include a portable operations center, unmanned surface vehicles using detection methods including towed sonar, and a remotely-operated vehicle to neutralize mines. Autonomous functionality in the system includes deployment and operation of payloads, as well as navigation by the unmanned surface vehicles, according to Cunnell.

The towed sonar provided by Thales uses multi-aspect synthetic aperture that is “very operationally efficient” at reducing false positives, which combined with system maturity and the open architecture makes the Thales system “the best out there,” according to Cunnell.

Thales sees “a lot of export opportunities” for the system, CEO Patrice Caine said in an interview at Euronaval “There are a lot of countries looking at it and saying, `We also want to keep our sailors safe,’ so to say.”

He told Defense News the company is in talks with potential customers, declining to provide further details.

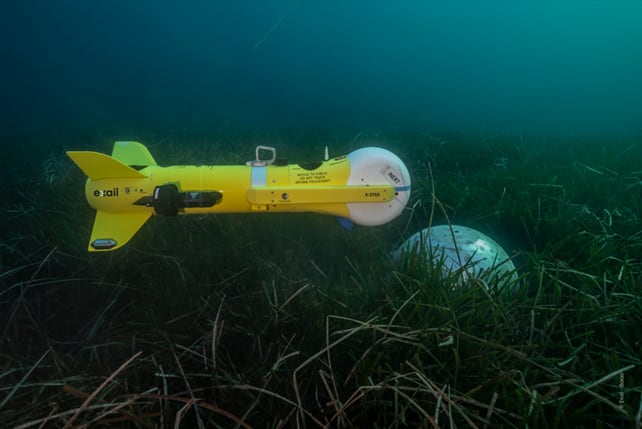

As part of the program, France is buying eight autonomous underwater drones from French firm Exail equipped with high-resolution sonar from Thales, with an option to acquire eight more, the Armed Forces said in a statement late Thursday. The first drones are expected to be delivered in the first half of 2028, with eight drones delivered to the Navy by mid-2030.

The drones will have a length of 5 meters and a diameter of around 47 centimeters, weigh 500 kilograms, have 10 hours of mission autonomy and an ability to dive to 300 meters.

The autonomous minehunting system is designed to replace all of France’s current mine warfare resources, including minehunters, sonar-towing vessels and diving vessels, the ministry said.

Mine detection is also evolving, and Thales has been experimenting with light detection and ranging, “lidar” for short, for mine hunting, analogous to how radar uses electromagnetic waves and sonar uses sound propagation.

The testing is linked to the Royal Navy’s Peregrine program, which has Thales working with helicopter-drone maker Schiebel to supply the U.K. with a naval surveillance UAV. The companies are looking at new payloads and capabilities to integrate, including lidar, James Dickie, product line architect for mine warfare systems at Thales in the U.K., told Defense News.

The biggest challenge for lidar lies in applying sufficient energy so there’s enough light in the water column, and Thales for that reason is looking at applications for mine detection in relatively shallow waters of up to about 20 meters.

Lidar will probably not replace sonar, and Thales for now sees the technology as complementary. One advantage is that light can be used for detection in the turbulent upper layers of the ocean, the “bubble layer,” where sonar is less dependable as it doesn’t work in air, according to Dickie.

Sonar “finds it’s really hard to travel through bubbles,” Dickie said. Thales is focused on using lidar for the layer of 3 to 5 meters “where we do have the challenge with acoustic technology.”

One of the reasons why Thales has looked at lidar is the surface mine threat in the Black Sea, where mines have broken free from their tether and are floating around. Black Sea countries are going to need a solution for drifting mines, according to Dickie.

“They’re really difficult to manage,” Dickie said. “The solution today is a person with binoculars looking for them. That’s not very reliable.”

The company is looking at a range of sensors for mine detection, including electro-optical, thermal, long-wave infrared and millimeter radar, for use from airborne platforms such as drones, but also from unmanned surface vehicles. Dickie said he expects lidar to have underwater applications, complementary to other detection methods.

“We’re not saying one is better than the other, it’s more about how we can use them for the given context,” Dickie said. “If it’s a poor-visibility day, camera is not going to work, but you’re going to get some utility from lidar and you’ll get some utility from radar. So it’s about finding the right sensor for the job.”

Mines are starting to be designed with geometries and materials to make acoustic sensing less effective, and lidar may have a role to play there, as well as technologies such as quantum magnetometers, according to Dickie.

Rudy Ruitenberg is a Europe correspondent for Defense News. He started his career at Bloomberg News and has experience reporting on technology, commodity markets and politics.