WASHINGTON — After L3Harris Technologies acquired one of the two U.S.-based solid rocket motor providers in July, the new division’s chief embarked on a barnstorming tour of the sector.

For nearly two months, Ross Niebergall bounced from one newly acquired Aerojet Rocketdyne facility to another, he told Defense News, spending just two days in his home office as he reviewed propulsion production processes for critical weapons such as the Javelin, Stinger and Guided Multiple Launch Rocket System. One of his goals: finding ways to open up the military’s constricted pipeline for rocket motors.

With the $4.7 billion purchase, L3Harris made itself a key player in the lucrative world of missiles, munitions, hypersonic technologies and other weapons. It’s a rapidly expanding sector — one that will most certainly keep growing amid global turmoil, from Israel to Ukraine to the Pacific region, said analyst Roman Schweizer with the Cowen Washington Research Group.

Experts say the increasing demand but limited supply for the roughly $60 billion global rocket and missile propulsion market could continue to drive further acquisitions, partnerships and expansions. And some researchers believe that market could be worth $85 billion to $93 billion by the end of this decade.

Such deals could lead to new investments in the field, potentially expanding the pipeline for critical parts and systems and boosting supply.

Indeed, other companies in the rocket propulsion industry are making their own moves, reshuffling the market with potentially wide-ranging effects.

Smaller defense technology firm Anduril Industries, for instance, in June acquired solid rocket manufacturer Adranos, which specializes in a high-performance solid rocket fuel it calls ALITEC. The deal gives Anduril its first foothold in the missile market.

Additionally, X-Bow Systems, a small aerospace firm in Albuquerque, New Mexico, founded in 2016, surprised competitors in the solid rocket motor industry when it received in September a $64 million contract from the Pentagon for Army and Navy hypersonic boost propulsion systems. X-Bow, pronounced “crossbow,” became the first new company in decades to supply solid rocket motors to the Defense Department.

And Lockheed Martin — whose bid for Aerojet Rocketdyne was stymied by federal regulators last year — is in late-stage negotiations to partner with an unidentified rocket propulsion supplier, though details on that partnership remain scarce.

Over the last decade, the Pentagon’s annual budget requests for missiles and munitions procurement as well as related research and development have more than tripled, from $9 billion in fiscal 2015 to $30.6 billion in fiscal 2024. And it’s unlikely lawmakers will stop pressuring the Pentagon to catch up with China and Russia on developing hypersonic weapons.

This could mean continued jockeying as companies seek to position themselves.

“There’s a stronger demand signal than there is supply, and some people see an opportunity to build into these markets,” said Byron Callan, a defense industry analyst and managing partner at the research firm Capital Alpha Partners. “You see a need, you’re going to fulfill it.”

L3Harris makes its play

In a September interview at L3Harris’ Washington office, Niebergall said the company in early 2022 reviewed which defense markets it had a hand in — and where it was essentially on the sidelines.

One area that jumped out was the missiles and rocket industry, a multibillion-dollar market “that we weren’t effectively participating in a significant way,” he said.

When Lockheed Martin backed off its attempted acquisition of Aerojet Rocketdyne following a Federal Trade Commission lawsuit, L3Harris saw an opening to make itself a major supplier in the growing rocket engine and propulsion business.

L3Harris envisioned Aerojet as mainly acting as a supplier on major programs, not a prime contractor. That strategy would allow L3Harris “to be on as many teams as possible” for missiles and rocket programs.

Now, L3Harris is trying to determine how to apply its expertise and resources to the Aerojet business. As Niebergall toured Aerojet facilities and as L3Harris combed through the workflow processes for flagship programs — including propulsion systems for the Guided Multiple Launch Rocket System, the Army Tactical Missile System, the Standard Missile series and the Patriot air defense system — the company found chokepoints a tier lower in the supply chain.

For example, Niebergall said, with some weapon programs’ designs dating back to the 1970s, often only a single, small manufacturer is qualified to make a particular kind of steel motor case or component Aerojet needs. This hinders the company’s ability to surge production on such systems if necessary.

And in some cases, Niebergall said, Aerojet didn’t have full visibility into the programs on which it served as a subcontractor and was “held at arm’s length from understanding the full mission.” Without that full picture, Aerojet was unable to suggest ways to refine or improve customers’ requirements, he added.

But now L3Harris can “bridge that gap and bridge that understanding,” Niebergall said.

“My focus is going to be working to help create the health of that entire supply chain so that we can ramp up our delivery for what we anticipate are increased demands,” he explained.

This story will likely continue to play out in the market, said Bryan Clark, a senior fellow at the Hudson Institute think tank. As companies’ work on missiles, space rockets and hypersonic tech takes up a greater share of the market, he explained, firms will want to insulate themselves from supply disruptions caused by labor disputes or a lack of parts.

“Rocket fuel in particular is one where there’s a very limited industrial base,” Clark told Defense News. “So having another path of supply is going to be really important. Because energetics, there’s only a couple of companies that make them, and they’re somewhat dependent upon a unified supply chain when it comes to the underlying chemical materials.”

Indeed, the solid rocket motor-industrial base in the U.S. has gone through multiple changes in recent decades, according to a 2017 report by the Government Accountability Office. Since 1995, GAO said, the industry consolidated from six U.S. manufacturers to two — Aerojet Rocketdyne and Orbital ATK.

For its part, Lockheed Martin wants additional solid rocket motor suppliers to augment its pipeline and strengthen the supply chain, chief executive Jim Taiclet said during an Oct. 17 earnings call.

“Our objective is to bring anti-fragility into our own supply chain first, and to broadly apply that to the DoD,” he said.

The first step, Taiclet explained, is to find another rocket motor supplier for the Guided Multiple Launch Rocket System — a role now filled by both Northrop Grumman and Aerojet Rocketdyne — and then expand this approach to other programs.

“We want to augment our existing supplier and have a dual source, frankly,” Taiclet said. “That will extend into other systems, large and small and legacy and advanced.”

Lockheed is still in partnership negotiations with an unidentified company, Taiclet noted, but more could be on the way.

That company might be Nammo, a rocket motor firm based in Norway that also operates in the U.S., Callan said in a newsletter to investors.

“This is not a one-shot deal,” he added. “It’s going to be a long journey, and we’ll probably have additional participants and programs as the years and even decades roll on.”

In 2024, L3Harris’ first full year after the Aerojet acquisition, Niebergall said the parent firm will focus on modernizing the subsidiary’s rocket propulsion manufacturing in Camden, Arkansas; Huntsville, Alabama; and Orange County, Virginia, under a nearly $216 million Pentagon contract Aerojet received in April under the Defense Production Act. This is intended to accelerate the production and delivery of Javelin, Stinger and Guided Multiple Launch Rocket System weapons for Ukraine.

Over decades of production, those weapons have been hampered by inconsistent stop-start patterns of orders and deliveries. Because Ukrainian forces use those three systems so heavily in its fight against Russia’s invasion, the U.S. Army and the Pentagon anticipate a long-term need and want to be able to rapidly scale up production.

“Aerojet Rocketdyne in and of [itself] is a 5,200-person company,” Niebergall said. “Now we’re bringing the resources of a 52,000-person company to manage that as a program.”

Once L3Harris and Aerojet make production of those weapons more consistent and prolific, Niebergall added, the parent company plans to use those upgrades as a blueprint for the rest of its programs and systems. That will include applying digital tools commonly used at L3Harris to increase automation of legacy Aerojet weapons, he said.

Alan Chvotkin, a government contracting expert and partner at Washington law firm Centre Law Group, said the Aerojet acquisition “propels L3Harris into a much higher level tier among defense suppliers” and could continue driving its growth.

And if L3Harris can help Aerojet produce more propulsion systems — and faster — the Pentagon and prime defense firms would have more options from which to choose, Callan said.

L3Harris has not ruled out its potential to serve as prime contractor on some weapons programs. Last year, for example, it was one of three companies vying to create a new stand-in attack weapon for the F-35 fighter jet. Northrop Grumman ultimately won that contract.

“We will certainly look at opportunities [to bid as a prime contractor] where it makes sense, based on our capabilities,” Niebergall said.

Anduril jumps in

Six-year-old Anduril has typically focused on emerging technologies like artificial intelligence and autonomous drones. But its acquisition of Adranos — the company did not disclose its value — gives Anduril a toehold in the hypersonic technology and missile market.

Chris Brose, Anduril’s chief strategy officer, said the war in Ukraine has highlighted how critical it is to expand this market.

“We don’t have enough weapons. We don’t have enough rocket motors to put on the back of the weapons that we’re going to need to have,” Brose said. “That pie needs to grow, and we want to help win a share of the growing pie.”

He said a driving force behind that problem is a lack of capacity in the solid rocket motor-industrial base, in which Aerojet Rocketdyne and Orbital ATK — acquired by Northrop in 2018 — do the lion’s share of the work. There’s enough growth potential that a smaller company can compete and broaden the industrial capacity for rocket and missile production in the process, he argued.

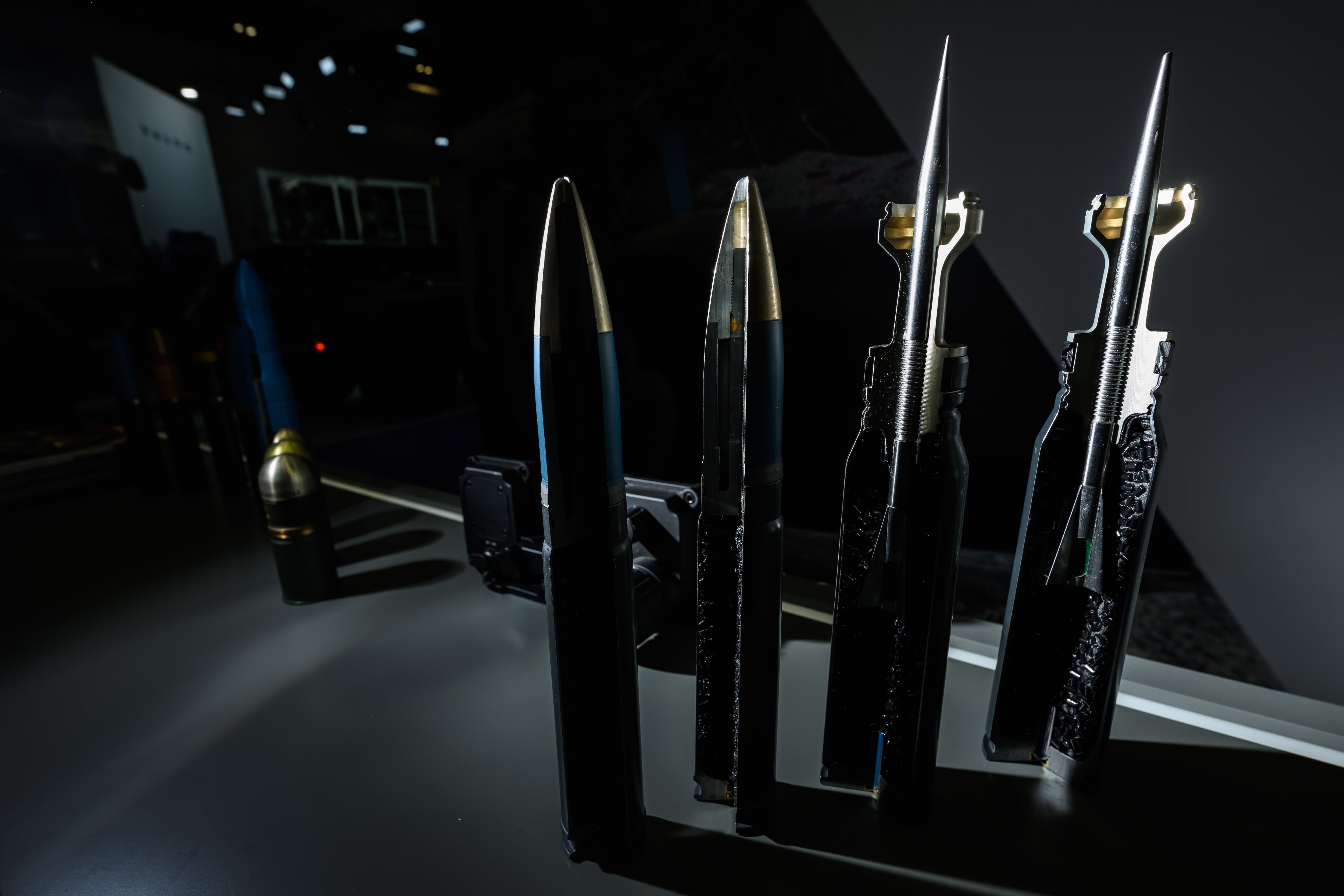

Solid rocket motors are used to propel everything from air-launched missiles to heavy-lift rockets that launch satellites into space. They burn a solid propellant consisting of a fuel and oxidizer mixture, which is encased in a cylinder, ignited and exhausted through a nozzle.

“Even if the government were pouring money into both of those companies, we’re still going to need more capacity to generate the weapons required to be relevant in an INDOPACOM scenario,” Brose said, referring to the potential for conflict in the Indo-Pacific region involving the U.S. military.

“The government needs Aerojet Rocketdyne. The government needs Northrop Grumman-Orbital ATK. But we also need new capacity, new entrants who can really get to scale and provide rocket motors to produce larger quantities of weapons,” Brose added.

In the last year or so, Anduril began seriously looking for a way to enter this market. Executives considered Adranos “far and away” the best positioned for an acquisition, given its potential production capacity in Mississippi, the technological advancements of its production methods, and its high-performance, high-range ALITEC propellant.

Brose said ALITEC could be useful for multiple weapons, particularly the RTX-made Advanced Medium Range Air-to-Air Missile. And Anduril sees opportunities to provide rocket motors for everything from anti-tank munitions to advanced hypersonic weapons. Brose said Anduril is in discussions with prime contractors on such programs.

Anduril’s acquisition of Adranos brought with it the smaller company’s 450-acre production facility in Mississippi, set up to produce these systems. The parent firm is now looking to modernize and further develop that facility to bolster production capacity, Brose said, and allow for the production of more standard solid rocket motors in addition to more motors that use ALITEC fuel.

A new entrant

X-Bow Systems, a small company of about 100 employees, originally focused on commercial small launches when it was founded in 2016, chief executive Jason Hundley told Defense News. Its plan was to buy solid rocket motors from major suppliers, he said, but the company quickly found that was unaffordable.

“If we were going to be serious about this launch technology based on solid rocket motors, to do this economically, we were going to have to take this problem on ourselves,” Hundley said. “Because we didn’t know of any other suppliers out there.”

X-Bow took a different approach and now specializes in three areas: launch services, energetics technology, and designing and building an array of solid rocket motors.

But as the firm broadened its reach, it saw the U.S. military’s scope also widening to encompass hypersonic programs. Also in play was the Air Force’s next-generation nuclear missile, dubbed Sentinel. These two areas were receiving significant investments, with the Sentinel procurement alone likely to cost at least $85 billion.

The company began to try to crack the military propulsion market, and its move paid off in September with a $64 million contract, making it a large solid rocket motor provider for the Pentagon — the military’s third.

Under this contract, X-Bow’s solid rocket motors will power the Navy’s hypersonic all-up round for its Conventional Prompt Strike weapon system as well as the Army’s Long-Range Hypersonic Weapon System.

X-Bow in February opened a new facility at a decommissioned airport in Luling, Texas, south of Austin, to build solid rocket motors and hypersonic technology. The firm plans to spend $25 million developing the facility over the next two years. In a release earlier this year, the company said it had already finished building a hangar and several solid rocket motor test pads there.

Hundley said X-Bow’s smaller footprint at locations such as its Texas facility will allow it to focus on affordability as it creates propulsion systems for the Army and Navy.

‘Massive demand’

Even as these companies expand, demand continues to grow. The Ukrainian military has rained down scores of artillery shells and rockets on Russian targets on a virtually daily basis, while Israel has launched airstrikes at the militant group Hamas in the Gaza Strip.

Both Ukraine and Israel receive supplies from the United States. And to fill those battlefield needs — plus stock U.S. forces and other foreign customers — continued government and market investment in this sector is almost guaranteed, according to Schweizer, the defense analyst with Cowen Washington Research Group.

“There’s massive demand for rocket motors,” Schweizer said. “And when there’s an oversized market opportunity, companies will go after that. That’s where the money’s at.”

But with relatively few companies providing such technology, he noted, over time the industry may see new entrants reach the upper end of the high-performance rocket market.

“There’s also some concerns within DoD about having such a constrained industrial base and supply chain, so it’s a function of expanding that as well,” Schweizer said.

Anduril and other companies “look at the billions of dollars that are going to be spent on refilling U.S. weapons inventories, increasing stockpiles, the fact that there are hundreds of rocket-propelled munitions being shot every day,” he added. “There is significant demand for at least a decade or more.

“It’s just, sadly, a good business to be in right now, given the state of affairs in the world.”

Stephen Losey is the air warfare reporter for Defense News. He previously covered leadership and personnel issues at Air Force Times, and the Pentagon, special operations and air warfare at Military.com. He has traveled to the Middle East to cover U.S. Air Force operations.