A disinformation campaign targeted a company planning to build mineral processing facilities in Texas last summer. A Chinese cyber group called DragonBridge developed fake social media profiles and posted images of angry protestors calling on Texans to rally against a new rare earth element-mining and -processing plant to be built nearby.

That campaign failed, but it demonstrates some of the threats that will likely continue to affect the mineral supply chains in the United States and elsewhere. With closer multinational cooperation, the U.S. and its allies and partners could reduce vulnerabilities emanating from the dependency on China, and other potentially unstable mineral sources, and counter hybrid attacks on domestic production lines.

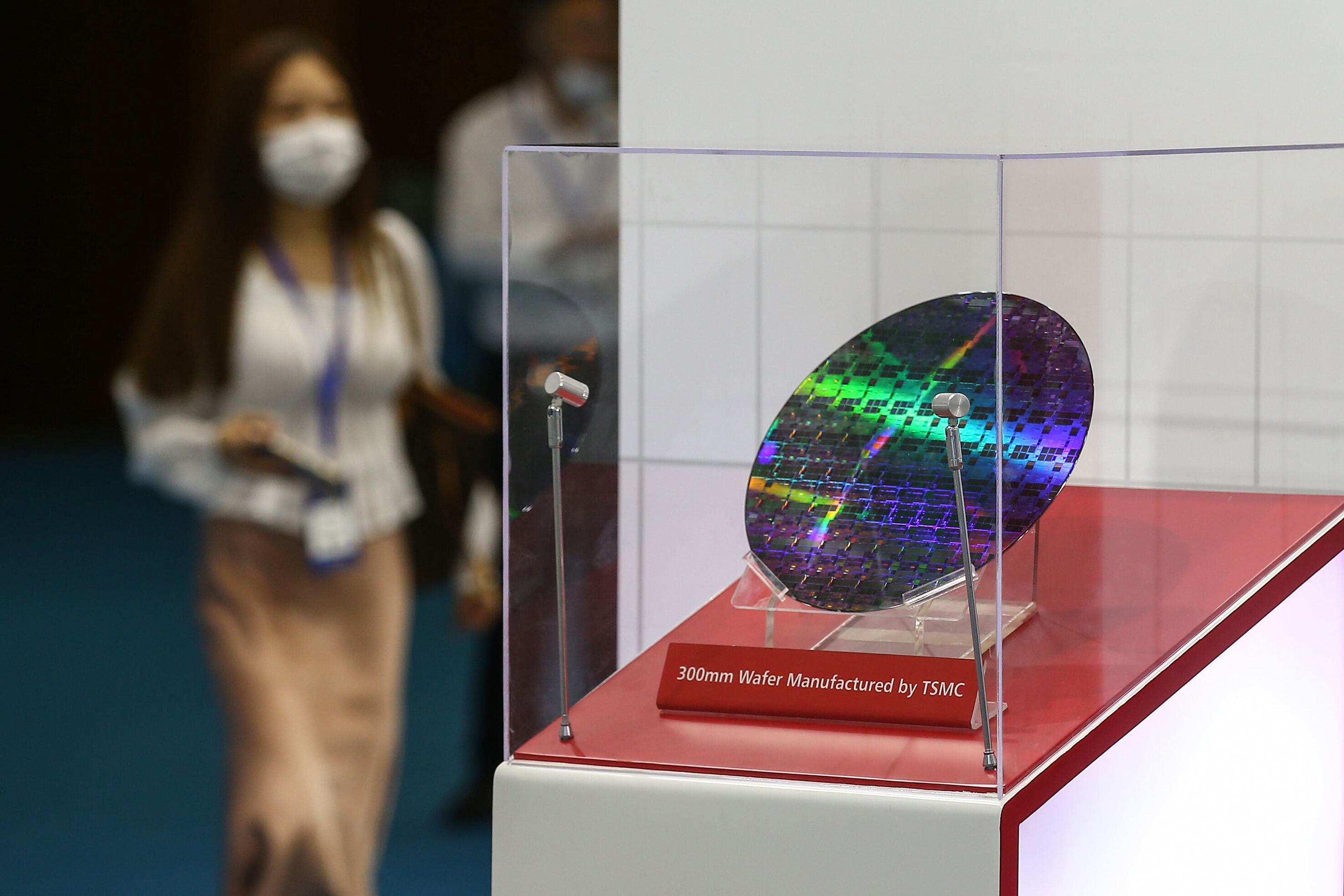

Rare earth elements and materials used in lithium-ion batteries are among the 50 materials deemed critical or strategic to the U.S. They are used in aeronautics, military surveillance systems and satellite communications, and they are critical for clean energy technologies like electric vehicles. Most are sourced from overseas — China, Australia, Canada, Russia, Africa or Central Asia — but it is China that dominates extraction and processing.

In 2017-2020, 76% of rare earth elements imported into the United States came from China. In Europe, it was 98%. Worse, the U.S. and its European allies lack processing facilities, so what is mined in the United States has been shipped to China for refining.

This kind of foreign dependence is risky. Supplies from China, or from other countries that have tumultuous domestic security situations, may be unreliable. Supplies could unexpectedly decline or be deliberately cut off for political, strategic or security reasons — or simple economic factors.

Prices fluctuate, too, influenced by heavy subsidies, government export controls or illegal market activities. A disruption to mineral exports would harm the U.S. and its allies’ defense industries’ ability to produce, repair or modernize their equipment. This is no longer speculative: Deliveries of the F-35 fighter jets were stopped in 2022 due to sourcing of cobalt. China has already used its near monopoly on rare earth elements as a political weapon against Japan (in 2010) and more subtly in the trade war with the United States in 2019. Meanwhile, China has also adopted or prepared laws increasing export controls and giving priority to its own industries.

Instability in other countries could shift material supply as well. The war in Ukraine and the resulting punitive sanctions against Russia have affected access to Russia’s raw materials and led to wider material market volatility.

RELATED

Several African countries also supply critical raw materials. Niger, for example, is one the world’s top uranium exporters, but it has a deteriorating security situation because of West African extremist organizations. The Democratic Republic of Congo’s problems with cobalt mining are also well documented.

The U.S. and its allies and partners have started reducing risky dependencies, primarily by strengthening domestic rare earths and lithium-ion battery material supply chains, including in the defense sector. Forging multinational redundancy systems could add more reliability — particularly during the challenging process of cutting unreliable links out of critical supply chains. Even if such cooperation remains rare, the foundations are already in place: The United States has released joint statements and signed agreements with multiple countries on critical material supply chains, security of dual-use technology, and mutual supply of defense goods and services.

The Pentagon has already asked Congress for permission to fund strategic mineral facilities in Australia and Britain. A potentially groundbreaking development was the launch of the multinational Minerals Security Partnership in June 2022. This is an attempt, in the words of Treasury Secretary Janet Yellen, to “friend-shoring” minerals — or “get the benefits of trade so we have multiple sources of supply and are not reliant excessively on sourcing critical goods from countries where we have geopolitical concerns.”

These multinational efforts are still new, and only time will reveal their level of success. But in another sensitive area — defense capabilities — common interests have led to a range of useful, collaborative models. Short-term solutions could include developing joint material reserves or creating barter and resource-sharing mechanisms that kick in if a country loses its access to a supplier. Longer-term solutions could include joint construction of material processing plants — an otherwise very expensive endeavor — or cooperative development of effective and affordable substitutes for critical materials.

Further, many resource-rich countries have been overlooked in these recent agreements. If the supply chains are to diversify away from China, critical mineral producing countries such as Vietnam, Chile, Argentina, Indonesia, the Philippines, Brazil, Cuba, Papua New Guinea, Madagascar and Mozambique could all be candidates for similar efforts. A clear security-of-supply policy that includes these countries could create additional pathways for better access to critical materials while also reducing so-called artisanal mining and countering China’s long-term economic influence.

In the future, if a favorable security and political situation exists in these material-rich countries, the United States and its allies and partners potentially could create more efficient supply lines by locating processing plants near mineral extraction or production sites. Vertical integration produces efficiencies and drives the location of these plants, either near the mines or near the magnet and battery production.

Right now, the largest battery producer — China — is also dominating battery material separation and processing as well as component manufacturing, thus also dominating the downstream end of mineral processing. The same can be said for rare earth magnets.

Multinational, collaborative models of this sort are not easy. They require political will, agreed-upon funding mechanisms, supporting legislation, realistic ambitions and mutual trust. Despite that, on critical mineral supplies it could be partnership rather than isolationism that reduces American vulnerabilities from competitors and less reliable suppliers.

Marta Kepe is a senior defense analyst at the think tank Rand, where Fabian Villalobos is an associate engineer.