WASHINGTON — Production of a component vital to protecting American troops from chemical attacks that can’t keep up with need. Key suppliers of aircraft parts that could go bankrupt at any time. A key producer of missile components that closed for two years before the Pentagon found out.

These are just some of the key findings of an annual report from the Pentagon judging the greatest risks to the defense industrial sector, underlining that while the overall defense industry continues to bring in massive profits, not all is well among the suppliers of key components that, while small pieces of larger systems, could impact America’s ability to wage war.

The annual “Industrial Capabilities” report, quietly released May 13 by the Defense Department’s Office of Manufacturing and Industrial Base Policy, found that despite total dollars spent by the department on weapons and ammunition increasing year over year since 2016, the number of vendors supplying them has decreased.

In addition, while the report found generally positive trends for the U.S. defense sector, it did warn that in certain areas, foreign weapon sales are decreasing.

For instance, the U.S. saw its market share of global naval weapon exports go from 63 percent in 2007 to just 17 percent in 2017. And from 2008-2017, two reliable buyers of U.S. defense goods — Pakistan and South Korea — saw their U.S. procurement percentages drop. Pakistan went from 31 percent to 12 percent, while South Korea went from 78 percent to 53 percent.

This is the first Industrial Capabilities report to be published since the October release of a White House-mandated study on the defense-industrial base. That study concluded, in part, that the government needs to increase use of its Defense Production Act Title III authorities, which allows the government to expend funds to support key production lines that might now otherwise survive.

RELATED

The latest report says that through March 2019, seven presidential determinations were issued to address “key industrial base shortfalls in lithium sea-water batteries, alane fuel cell technology, sonobuoys production, and critical chemicals production for missiles and munitions.” However, details of those agreements, such as how much funding might go toward fixing the issues, were pushed into a nonpublic appendix.

Here are the biggest concerns, broken down by sector:

Aircraft: The report cites long product and system development timelines, high costs for development and qualification, and limits on production as broad issues in the aircraft sector. Those issues are inherent in major defense programs, but the report also calls out the aging workforce and consolidation among the industrial base, which “has expanded into the sub-tiers of the supply chain, creating additional risks for single or sole source vendors.”

As an example, the report notes there are only four suppliers with the ability to manufacture “large, complex, single-pour aluminum and magnesium sand castings” needed to make key parts of military aircraft. These four suppliers face “perpetual financial risk and experience bankruptcy threats” due to the insecure nature of Pentagon funding.

“The single qualified source for the upper, intermediate, and sump housing for a heavy-lift platform for the Marines has experienced quality issues and recently went through bankruptcy proceedings,” the report adds. “Without a qualified or alternate qualified source for these castings, the program will face delays, impeding the U.S. ability to field heavy-lift support to Marine Corps expeditionary forces.”

Finding qualified software engineers is another issue identified, with the report warning it is “increasingly difficult to hire skilled, cleared, and capable software engineers. As aircraft continue to increase in software complexity, it will become even more important for the sector to hire skilled software engineers.”

Ground systems: The report says the Pentagon’s plan of incremental updates to existing systems rather than wholesale new designs has created “a generation of engineers and scientists that lack experience in conceiving, designing, and constructing new, technologically advanced combat vehicles.” But the same issues of consolidation and lack of budget stability that showed up in the aircraft sector impact the ground vehicle sector.

“Legislation and DoD industrial policy requires DoD to manufacture all large-caliber gun barrels, howitzer barrels, and mortar tubes at one organic DoD arsenal,” the report cites as an example. “There is only one production line at the arsenal for all of these items, and policy modifications to meet demand and surge from overseas have led to a lack of capacity to meet current production requirements.”

Shipbuilding sector: When it comes to maritime vessels, the “most significant risks found were a dependence on single and sole source suppliers, capacity shortfalls, a lack of competition, a lack of workforce skills, and unstable demand,” the report found.

The lack of competition goes from the highest levels, where four companies control the seven shipyards building military vessels, to the lowest components, such as “high-voltage cable, propulsor raw material, valves, and fittings.”

Workforce concerns also dominate the shipbuilding sector. The report cites statistics from the Department of Labor predicting that between 2018 and 2026, there will be a 6–17 percent decrease in U.S. jobs in occupations critical to Navy shipbuilding projects, “such as metal layout (ship-fitting), welding, and casting.” If that is not addressed, a lack of skilled workers “will significantly impact the shipbuilding industry’s ability to meet the Navy’s long-term demand.”

Munitions sector: A major concern in last year’s annual report was the future of the U.S. munitions sector, and many of those issues remain in the 2019 version. The report identified “multiple risks and issues, including material obsolescence and lack of redundant capability, lack of visibility into sub-tier suppliers causing delays in the notification of issues, loss of design and production skill, production gaps and lack of surge capacity planning, and aging infrastructure to manufacture and test the products.”

RELATED

As an example, the report points to a voltage control switch, used in ignition devices and flight termination systems for Department of Defense missiles. Several years ago, the foundry that made a key component for the switch was purchased by another foundry, which then decided to close the factory. The Pentagon was not informed until two years after the foundry was closed, at which point “it became evident that the end-of-life buy, which was designed to last from three to five years, would only last six months.”

In another case, two key chemicals in solid-fuel rocket motors became obsolete, requiring the DoD to scramble for potential replacements.

Chemical, biological and radiological sector: The chemical, biological, radiological and nuclear defense sector provides protection for war fighters through items like respirators, masks and vaccines. But the report found serious issues regarding the industrial base’s ability to provide that capabilities, indicating that Title III authorities might be needed in the near future to maintain production.

As an example, the report points to production of ASZM‑TEDA1 impregnated carbon, a defense-unique material with only a single qualified source that, as a result, “precludes assurances for best quality and price.” The carbon is used in 72 chemical, biological and nuclear filtration systems, and the report notes that current sourcing arrangements “cannot keep pace with demand.” The DoD is already using Title III to modernize the production line and try to establish a second source for the material.

Soldier systems: The collapse of the American textile market over the last three decades has left the department depending on single sources or foreign suppliers for soldier systems. Additionally, battery production is identified as a potential future issue.

“Lack of stable production orders has resulted in lost capability and capacity, increased surge lead times, workforce erosion, and inhibited investments by remaining suppliers. Surge-capacity-limiting constraints occur at several points along the value chain, from raw material to final battery assembly,” the report says.

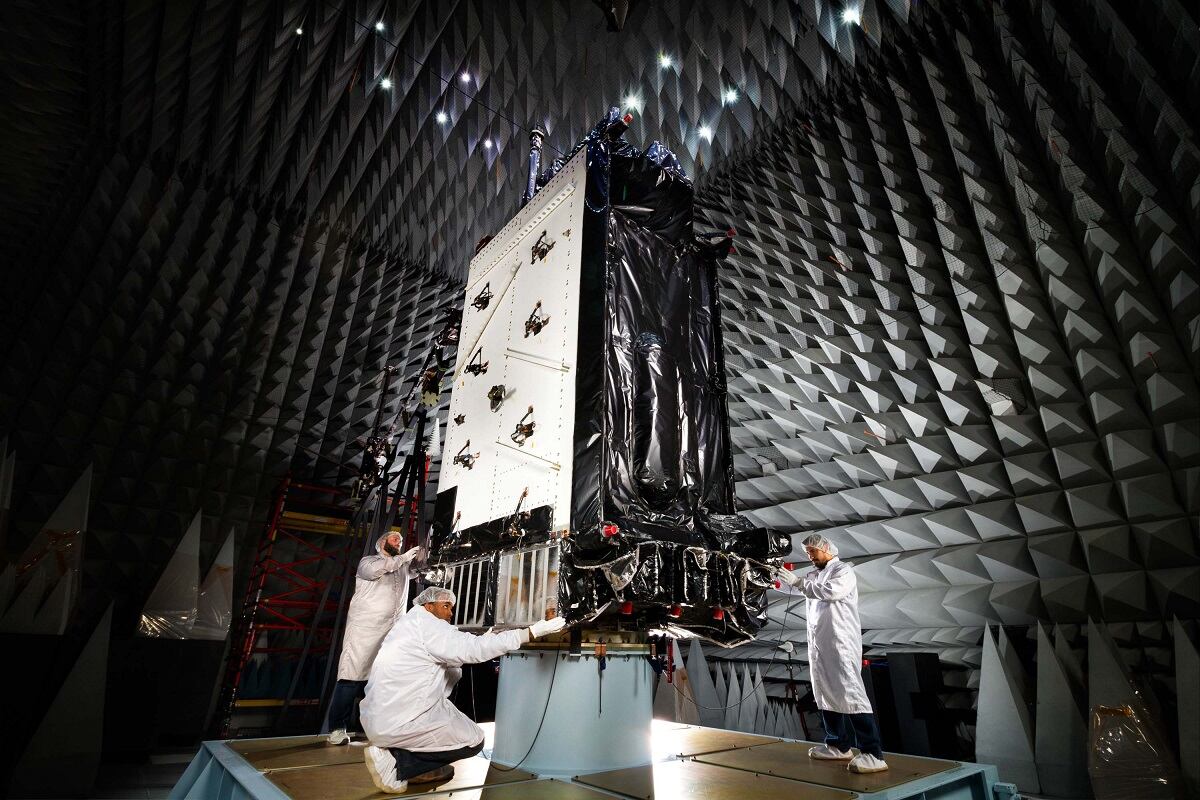

Space systems: Aside from major issues around future threats to space assets from near-peer competitors, the report identifies major industrial base concerns for space as including “aerospace structures and fibers, radiation-hardened microelectronics, radiation test and qualification facilities, and satellite components and assemblies.”

Other areas include solar panel development — “There is not enough space business for companies to justify R&D to improve cells without [government] help,” the report says — the erosion of the traveling-wave tube industry, and a lack of suppliers for key parts needed to produce precision gyroscopes needed for spacefaring systems.

Electronics: The Pentagon has been sounding the alarm about China’s growing power in the printed circuit board market, and this report continues that trend. The United States now accounts for only 5 percent of global production, representing a 70 percent decrease from $10 billion in 2000 to $3 billion in 2015, per the report. Meanwhile, almost half of global production comes from China.

Aaron Mehta was deputy editor and senior Pentagon correspondent for Defense News, covering policy, strategy and acquisition at the highest levels of the Defense Department and its international partners.